Representative Office in Thailand is a foreign company as a service business which is not required to obtain the Foreign Business License (FBL) according to the Ministerial Regulation “Prescribing Service Business Which Do Not Require a Foreign Business License (No.3) B.E. 2560 (2017).

General characteristics

- Non-revenue generating activities

- No authority to accept purchasing order or to make offer for selling or to negotiate for carrying out of business with person or juristic person in the country in which it is established.

- All expenditures incurred by the Representative Office must be born by the head office.

- It is not subject to corporate income tax, in accordance with revenue code except deposit interest of remitted funds from the head office has to pay tax.

Scope of business

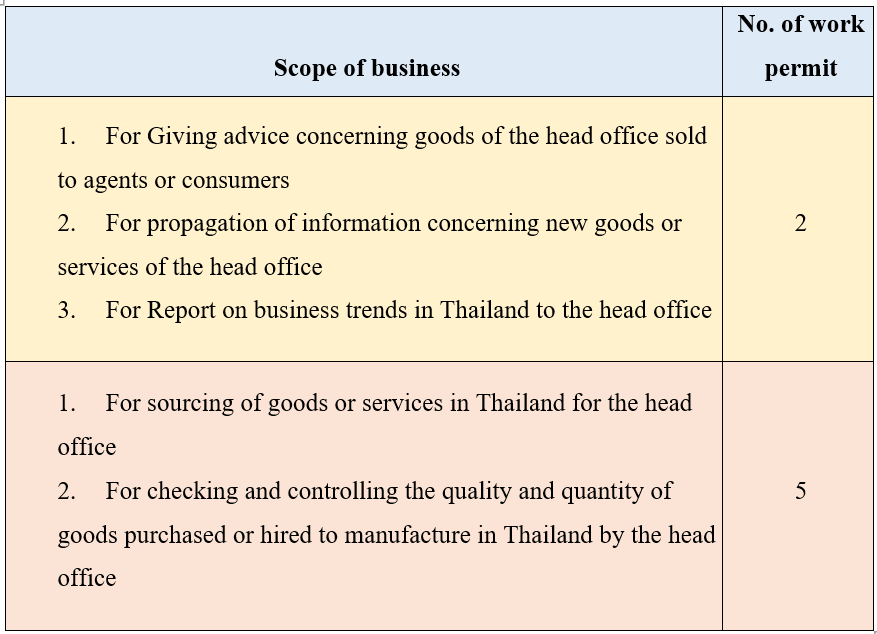

Under the Regulation of the Office of the Prime Minister in Establishment of Work Permit and Visa Center (No. 3) B.E. 2544 (2001). The definition of the Representative Office is “International Trading Business” which business activity that Representative Office (the “RO”) can carry out are limited to 5 business activities as follows:

- Sourcing of goods or services in Thailand for the head office

- Checking and controlling the quality and quantity of goods purchased or hired to manufacture in Thailand by the head office

- Giving advice concerning goods of the head office sold to agents or consumers

- Propagation of information concerning new goods or services of the head office

- Report on business trends in Thailand to the head office

Accounting Duty

Representative Office has the accounting duty to prepare and submit the financial statement to the related Government Department pursuant to the Notification of the Department of Business Development on Directions Pursuing Accounting Law to be applied with a Juristic Person Established under Foreign Law But Operating Business in Thailand Prescribed as the Person Charged with the Accounting Duty, B.E. 2559 (2016)

Therefore, the Representative Office shall register its exiting in Thailand for such accounting duty by submission to the DBD and obtain the juristic person No. for using as its Tax ID No. for this matter.

-

Requirements

- The minimum capital remittance at least 2 Million Baht.

- At least 1 representative director who has a domicile in Thailand

- Address of Representative Office in Thailand

- Head Office’s documents and the last 3 years of financial statement with Notary Public

- Thai Translation of documents in (4)

-

Procedures

- Provide the Head Office’s documents and the last 3 years of financial statement with Notary Public and Thai Translation (At least 2 weeks)

- Provide the application and supporting documents for registration (At least 2-3 working days)

- Submit them to DBD and obtain the certified document (At least 3-5 working days)

-

Government Fees

2,500 THB

Tax Duty

Under the Revenue Code in Section 65 and 66, the Representative Office has no corporate income from 5 service business activities by itself. Therefore, the Representative Office does not have any duty to pay the corporate income tax in Thailand.

However, in case that there is any occurred interest of remitted capital which is remitted by head office or the interests on any remaining funds that it has received from the head office and deposited in its bank account. Such interest shall be calculated for the corporate income tax in accordance with Section 70.

Visa and Work Permit of representative and migrant workers

Under the regulation of Department of Employment B.E. 2552 (2009) related to bringing migrant workers to work for the Representative Office in the Kingdom which are as follows:

Our Services

- Providing application and supporting documents

- Contact and deal with authorities

- Providing and apply for Foreign Business Certificate

- Providing and report the project operation to DBD

- Translation

- Legalization by Ministry of Foreign Affair

- Legalization by Embassy

- Power of Attorney

- Notary Public

Contact us for free legal advices and affordable services.